Hood-rich

Smarter Than the Average Lib

Posts: 9,300

Joined: May 2016

I Root For: ECU & CSU

Location: The Hood

|

Every post election 90 day market shift since 1908

(This post was last modified: 03-02-2017 09:35 PM by Hood-rich.)

|

|

| 03-02-2017 09:22 PM |

|

UofMstateU

Legend

Posts: 39,238

Joined: Dec 2009

Reputation: 3580

I Root For: Memphis

Location: |

RE: Every post election 90 day market shift since 1908

bwahahahahahaobama........

|

|

| 03-02-2017 09:35 PM |

|

Hood-rich

Smarter Than the Average Lib

Posts: 9,300

Joined: May 2016

I Root For: ECU & CSU

Location: The Hood

|

RE: Every post election 90 day market shift since 1908

(03-02-2017 09:35 PM)UofMstateU Wrote: bwahahahahahaobama........

yeah, that's worse than I thought. then again they realized that America just elected a radical Marxist.

Sent from my SM-J700T using CSNbbs mobile app

|

|

| 03-02-2017 09:38 PM |

|

Fo Shizzle

Pragmatic Classical Liberal

Posts: 42,023

Joined: Dec 2006

Reputation: 1206

I Root For: ECU PIRATES

Location: North Carolina

|

RE: Every post election 90 day market shift since 1908

....and it is not a shock that Kennedy did well. The Liberals forget what a tax cutter he was.

|

|

| 03-03-2017 08:09 AM |

|

58-56

Blazer Revolutionary

Posts: 13,312

Joined: Mar 2006

Reputation: 840

I Root For: Fire Ray Watts

Location: CathedraloftheDragon

|

RE: Every post election 90 day market shift since 1908

Not sure I'd be bragging about being second to Herbert Hoover.

|

|

| 03-03-2017 08:17 AM |

|

nzmorange

Heisman

Posts: 8,000

Joined: Sep 2012

Reputation: 279

I Root For: UAB

Location: |

RE: Every post election 90 day market shift since 1908

(03-02-2017 09:22 PM)Hood-rich Wrote: make that 76 days.

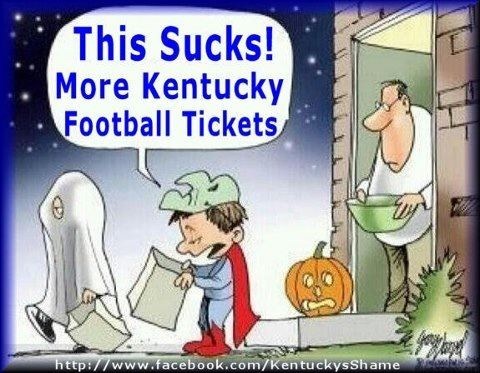

![[Image: 0283b9e3f7992e7d54a525a1b5d0c2ff.jpg]](https://uploads.tapatalk-cdn.com/20170303/0283b9e3f7992e7d54a525a1b5d0c2ff.jpg)

LOLbama

Sent from my SM-J700T using CSNbbs mobile app

To be fair, Obama's tough market was a result of the Great Recession meltdown that started before he was elected. It had nothing to do w/ him.

|

|

| 03-03-2017 10:18 AM |

|

VA49er

Legend

Posts: 29,088

Joined: Dec 2004

Reputation: 976

I Root For: Charlotte

Location: |

RE: Every post election 90 day market shift since 1908

(03-03-2017 10:18 AM)nzmorange Wrote: (03-02-2017 09:22 PM)Hood-rich Wrote: make that 76 days.

LOLbama

Sent from my SM-J700T using CSNbbs mobile app

To be fair, Obama's tough market was a result of the Great Recession meltdown that started before he was elected. It had nothing to do w/ him.

While partly true, his negativity didn't do any favors either.

(This post was last modified: 03-03-2017 10:51 AM by VA49er.)

|

|

| 03-03-2017 10:51 AM |

|

CardFan1

Red Thunderbird

Posts: 15,153

Joined: Oct 2011

Reputation: 647

I Root For: Louisville ACC

Location: |

RE: Every post election 90 day market shift since 1908

(03-02-2017 09:38 PM)Hood-rich Wrote: (03-02-2017 09:35 PM)UofMstateU Wrote: bwahahahahahaobama........

yeah, that's worse than I thought. then again they realized that America just elected a radical Marxist.

Sent from my SM-J700T using CSNbbs mobile app

But I always heard Obama created over a Billion new jobs ! Guess those weren't in this country.

|

|

| 03-03-2017 11:28 AM |

|

Hambone10

Hooter

Posts: 40,333

Joined: Nov 2005

Reputation: 1293

I Root For: My Kids

Location: Right Down th Middle

|

RE: Every post election 90 day market shift since 1908

Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

|

|

| 03-03-2017 12:32 PM |

|

nzmorange

Heisman

Posts: 8,000

Joined: Sep 2012

Reputation: 279

I Root For: UAB

Location: |

RE: Every post election 90 day market shift since 1908

(03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

|

|

| 03-03-2017 11:27 PM |

|

UofMstateU

Legend

Posts: 39,238

Joined: Dec 2009

Reputation: 3580

I Root For: Memphis

Location: |

RE: Every post election 90 day market shift since 1908

(03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

|

|

| 03-04-2017 12:02 AM |

|

nzmorange

Heisman

Posts: 8,000

Joined: Sep 2012

Reputation: 279

I Root For: UAB

Location: |

RE: Every post election 90 day market shift since 1908

(03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

(This post was last modified: 03-04-2017 01:27 AM by nzmorange.)

|

|

| 03-04-2017 01:26 AM |

|

JMUDunk

Rootin' fer Dukes, bud

Posts: 29,613

Joined: Jan 2013

Reputation: 1731

I Root For: Freedom

Location: Shmocation |

RE: Every post election 90 day market shift since 1908

(03-04-2017 01:26 AM)nzmorange Wrote: (03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

All these things ^^^ are correct to one degree or another. What cannot be refuted is this market is trading on the future. Outlook. Predictions. Optimism.

So far the bulls are outrunning the bears by a large margin. If the R's, and Trump don't deliver, expect a massive collapse.

In the meantime, it's a TALL order to move a market at 18,000 15% versus any other move in double digits. Going from 1000 to 1180 ain all that, 18000 to 21000 I'd posit is much tougher.

#somuchwinning

|

|

| 03-04-2017 01:43 AM |

|

nzmorange

Heisman

Posts: 8,000

Joined: Sep 2012

Reputation: 279

I Root For: UAB

Location: |

RE: Every post election 90 day market shift since 1908

(03-04-2017 01:43 AM)JMUDunk Wrote: (03-04-2017 01:26 AM)nzmorange Wrote: (03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

All these things ^^^ are correct to one degree or another. What cannot be refuted is this market is trading on the future. Outlook. Predictions. Optimism.

So far the bulls are outrunning the bears by a large margin. If the R's, and Trump don't deliver, expect a massive collapse.

In the meantime, it's a TALL order to move a market at 18,000 15% versus any other move in double digits. Going from 1000 to 1180 ain all that, 18000 to 21000 I'd posit is much tougher.

#somuchwinning

If it holds, then absolutely.

I personally think it's a bubble. In that case, the market isn't trading on the future as much as a belief in finding a bigger sucker.

But to be clear, I really, really hope it holds. I obviously want America to have as much success as possible, and I'd happily be proven wrong in exchange for prolonged booming economic prosperity.

|

|

| 03-04-2017 01:50 AM |

|

JMUDunk

Rootin' fer Dukes, bud

Posts: 29,613

Joined: Jan 2013

Reputation: 1731

I Root For: Freedom

Location: Shmocation |

RE: Every post election 90 day market shift since 1908

(03-04-2017 01:50 AM)nzmorange Wrote: (03-04-2017 01:43 AM)JMUDunk Wrote: (03-04-2017 01:26 AM)nzmorange Wrote: (03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

All these things ^^^ are correct to one degree or another. What cannot be refuted is this market is trading on the future. Outlook. Predictions. Optimism.

So far the bulls are outrunning the bears by a large margin. If the R's, and Trump don't deliver, expect a massive collapse.

In the meantime, it's a TALL order to move a market at 18,000 15% versus any other move in double digits. Going from 1000 to 1180 ain all that, 18000 to 21000 I'd posit is much tougher.

#somuchwinning

If it holds, then absolutely.

I personally think it's a bubble. In that case, the market isn't trading on the future as much as a belief in finding a bigger sucker.

But to be clear, I really, really hope it holds. I obviously want America to have as much success as possible, and I'd happily be proven wrong in exchange for prolonged booming economic prosperity.

Oh, today? It's most certainly a bubble. As all are when they happen, again all bidding on the future, and you may have some suckers in there. But, if the "suckers" are right, then someone loses too. So, hedge your bets, don't over extend and do due diligence. So far lots of people, in ALL walks of life, have made LOTS of money in a scant 3+ months.

Thanks, POTUS!

|

|

| 03-04-2017 01:58 AM |

|

nzmorange

Heisman

Posts: 8,000

Joined: Sep 2012

Reputation: 279

I Root For: UAB

Location: |

RE: Every post election 90 day market shift since 1908

(03-04-2017 01:58 AM)JMUDunk Wrote: (03-04-2017 01:50 AM)nzmorange Wrote: (03-04-2017 01:43 AM)JMUDunk Wrote: (03-04-2017 01:26 AM)nzmorange Wrote: (03-04-2017 12:02 AM)UofMstateU Wrote: The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

All these things ^^^ are correct to one degree or another. What cannot be refuted is this market is trading on the future. Outlook. Predictions. Optimism.

So far the bulls are outrunning the bears by a large margin. If the R's, and Trump don't deliver, expect a massive collapse.

In the meantime, it's a TALL order to move a market at 18,000 15% versus any other move in double digits. Going from 1000 to 1180 ain all that, 18000 to 21000 I'd posit is much tougher.

#somuchwinning

If it holds, then absolutely.

I personally think it's a bubble. In that case, the market isn't trading on the future as much as a belief in finding a bigger sucker.

But to be clear, I really, really hope it holds. I obviously want America to have as much success as possible, and I'd happily be proven wrong in exchange for prolonged booming economic prosperity.

Oh, today? It's most certainly a bubble. As all are when they happen, again all bidding on the future, and you may have some suckers in there. But, if the "suckers" are right, then someone loses too. So, hedge your bets, don't over extend and do due diligence. So far lots of people, in ALL walks of life, have made LOTS of money in a scant 3+ months.

Thanks, POTUS!

We may have different definitions of building on the future.

I wouldn't call tulips being worth a year's worth of wages "building on the future."

https://en.m.wikipedia.org/wiki/Tulip_mania

I also don't think that the Japanese real estate bubble had anything to do w/ the future (other than a hope of finding a bigger sucker)

1) https://en.m.wikipedia.org/wiki/Japanese...ice_bubble

2) https://en.m.wikipedia.org/wiki/Tokyo_Imperial_Palace

I think that the US market is in a mini version of the above. All the gains are noise. Trump being good, bad, or neutral isn't driving the market IMHO.

(This post was last modified: 03-04-2017 10:59 AM by nzmorange.)

|

|

| 03-04-2017 10:58 AM |

|

UofMstateU

Legend

Posts: 39,238

Joined: Dec 2009

Reputation: 3580

I Root For: Memphis

Location: |

RE: Every post election 90 day market shift since 1908

(03-04-2017 01:26 AM)nzmorange Wrote: (03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

It was the straw that broke the camels back. The underlying issues, such as with the mortgage problems, could have been fixed had the democrats, when they were in a minority, didnt filibuster and block the reforms that would have prevented it. But at least while they were not in charge, the economy kept humming along to absorb it.

When dimwit pelosi took control, thats when the economy started to skid. And when the economy started to skid, it allowed the housing issue to blow up.

That is factually true.

|

|

| 03-04-2017 11:05 AM |

|

nzmorange

Heisman

Posts: 8,000

Joined: Sep 2012

Reputation: 279

I Root For: UAB

Location: |

RE: Every post election 90 day market shift since 1908

(03-04-2017 11:05 AM)UofMstateU Wrote: (03-04-2017 01:26 AM)nzmorange Wrote: (03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

That's factually not true.

The Democratic Party took control of the Senate and House on Jan 3, 2007. The Great Recession was the result of more than 10 months and 6 days of policy. It was years in the making, and it involved both parties and a number of foreign and private forces.

It was the straw that broke the camels back. The underlying issues, such as with the mortgage problems, could have been fixed had the democrats, when they were in a minority, didnt filibuster and block the reforms that would have prevented it. But at least while they were not in charge, the economy kept humming along to absorb it.

When dimwit pelosi took control, thats when the economy started to skid. And when the economy started to skid, it allowed the housing issue to blow up.

That is factually true.

No. That's not true, either. Bubbles pop. By the time the Democrats got control of 1/3rd of the federal government and a minority of state governments, the bubble was already there. It's popping was inevitable, and popping it sooner was better than later. But even then, it was a Republican fed chair that correctly popped it by raiding rates on June 29th, 2006 (the June '06 - Oct. '07 delay was how long it took for the markets to adjust). And IMHO, the two biggest drivers of the bubble (other than the obvious reckless borrowing practices of millions of Americans) were: 1) a lack of regulations, and relatedly, 2) a lack of fear from a select group of bankers who essentially committed fraud.

But to be very clear, I don't mean to paint the DNC as blameless. They weren't. I also don't mean to paint the GOP as all bad. They weren't. Like most things in life, every significantly large group did some good and some bad. Your assertion that it was all the Democrat's fault and/or Pelosi's and/or somehow sparked solely by them is terribly misguided.

(This post was last modified: 03-04-2017 03:51 PM by nzmorange.)

|

|

| 03-04-2017 03:07 PM |

|

Owl 69/70/75

Just an old rugby coach

Posts: 80,803

Joined: Sep 2005

Reputation: 3211

I Root For: RiceBathChelsea

Location: Montgomery, TX

|

RE: Every post election 90 day market shift since 1908

(03-04-2017 03:07 PM)nzmorange Wrote: No. That's not true, either. Bubbles pop. By the time the Democrats got control of 1/3rd of the federal government and a minority of state governments, the bubble was already there. It's popping was inevitable, and popping it sooner was better than later. But even then, it was a Republican fed chair that correctly popped it by raiding rates on June 29th, 2006 (the June '06 - Oct. '07 delay was how long it took for the markets to adjust). And IMHO, the two biggest drivers of the bubble (other than the obvious reckless borrowing practices of millions of Americans) were: 1) a lack of regulations, and relatedly, 2) a lack of fear from a select group of bankers who essentially committed fraud.

But to be very clear, I don't mean to paint the DNC as blameless. They weren't. I also don't mean to paint the GOP as all bad. They weren't. Like most things in life, every significantly large group did some good and some bad. Your assertion that it was all the Democrat's fault and/or Pelosi's and/or somehow sparked solely by them is terribly misguided.

What regulation would have made a difference, and how?

|

|

| 03-04-2017 09:41 PM |

|

CardFan1

Red Thunderbird

Posts: 15,153

Joined: Oct 2011

Reputation: 647

I Root For: Louisville ACC

Location: |

RE: Every post election 90 day market shift since 1908

(03-04-2017 12:02 AM)UofMstateU Wrote: (03-03-2017 11:27 PM)nzmorange Wrote: (03-03-2017 12:32 PM)Hambone10 Wrote: Stock market movement after an election is mostly about 'optimism'.

Under Obama, he promised trillions of new spending and to 'tax the wealthy' (everyone making 250k or more) later to pay for it. THAT is why the market tanked. No reason to expect increased reported earnings if taxes on those earnings were going to rise. Of course SOME of it was the general tone of the market, but not all of it. Similarly about half of Trump's bump was 'baked in the cake' already.

https://en.m.wikipedia.org/wiki/United_S...of_2007–09

Obama had nothing to do w/ the over-heated economy in 2007 and the subsequent bear market that started on Oct. 9, 2007.

That's the overwhelming majority of what was driving the market. There was far too much noise to attribute anything to him.

Honestly, the same goes for Trump. It looks like we're in a bubble to me, which would mean that this is all noise. It will 100% be to Trump's credit if it lasts, but we won't know that until after the fact.

The economy and market started going south the moment the democrats and Pelosi took control of the house and senate.

BINGO ! Planned destruction of the economy to make W look bad and Democrats to regain Power

|

|

| 03-05-2017 10:47 AM |

|

![[Image: 0283b9e3f7992e7d54a525a1b5d0c2ff.jpg]](https://uploads.tapatalk-cdn.com/20170303/0283b9e3f7992e7d54a525a1b5d0c2ff.jpg)